Refinancing your mortgage can be a good money move for people in many situations, but it’s not for everyone. Read this article to find out more about refinancing and if it might be right for you.

The current environment—why now?

Interest rates are at historic lows. This can be less than great for savers, as the interest rate on savings accounts is close to zero on a regular checking and savings account. Even high yield online savings accounts yield little in interest.

As I write this, the interest rate on our high-yield online savings accounts is 0.40%, which is almost 10 times better than a savings account at our regular bank.

An account with $10,000 would yield $40 in interest per year. Not much, but at least that is far better than the $5 yield on a typical bank account “savings.”

But for borrowers—especially those with good and great credit—the current situation offers a great opportunity to be creative in future planning, right-size one’s debt-income ratio, and even fix some financial mistakes.

Mortgage rates for refinance are currently right around 3 percent for a 30-year refinance, and 2.30 percent for a 15-year refinance.

Several of my clients in the last year have either explored refinancing or completed a refinance for various goals. It is a lot of work, but it is worth it.

That means that most homeowners should take some time to consider refinancing their mortgage. This is especially true if you are pretty sure that you want to stay in the home for at least a few more years.

If you do not have a mortgage, especially if you are not a homeowner yet, I recommend you consider whether now or soon might be a good time to buy a home.

Some reasons to consider refinancing your mortgage

*to get cash to pay off higher-interest debt

If you have credit card debt that you struggle to pay off because of high interest rates, you do have options such as asking for a lower rate, opening a credit card with free balance transfer and 0% interest for a time.

But you can also refinance the mortgage to get rid of the debt, and then direct the money you were paying towards the credit card debt to savings accounts or other goals.

*to reduce monthly payments (free up monthly $ for other goals)

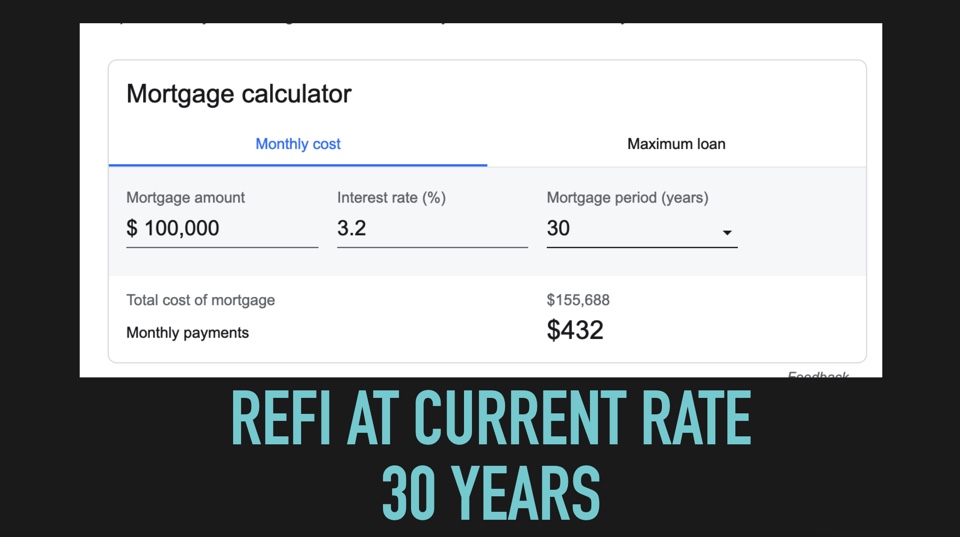

You can refinance a mortgage to have the same length of time left, or extend the course of the loan, reducing (sometimes drastically) the amount you pay per month. If you find that you are in

*to “lock in” historic low rates (less interest over course of loan)

*to reduce the time to house payoff

You could refinance with the same monthly payment and a shorter term, to pay off your loan sooner.

*if the numbers work out for you. See “run your numbers” below.

Some reasons not to refinance

*if you have a short time/low dollar amount left on loan.

If you only have a short amount of time left on your loan, or not much money left on the loan, refinancing may not make sense.

*if you are selling soon (really soon, depending on numbers)

If you plan to sell soon (say in a year or two), refinancing may not make sense. You need to “break even” before the mortgage refinance pays off. (See below)

*you already have a low interest rate

*there is too long of a “break-even” period before refinancing makes sense.

The Zillow refinance calculator is a good way to check on a refinancing.

*Your credit score is less than 700.

Without good or great credit, you may not be eligible for the best interest rates. Work to improve your credit score and then consider then if you want to pursue refinancing.

Ways to refinance

*Option: refinance for cash out

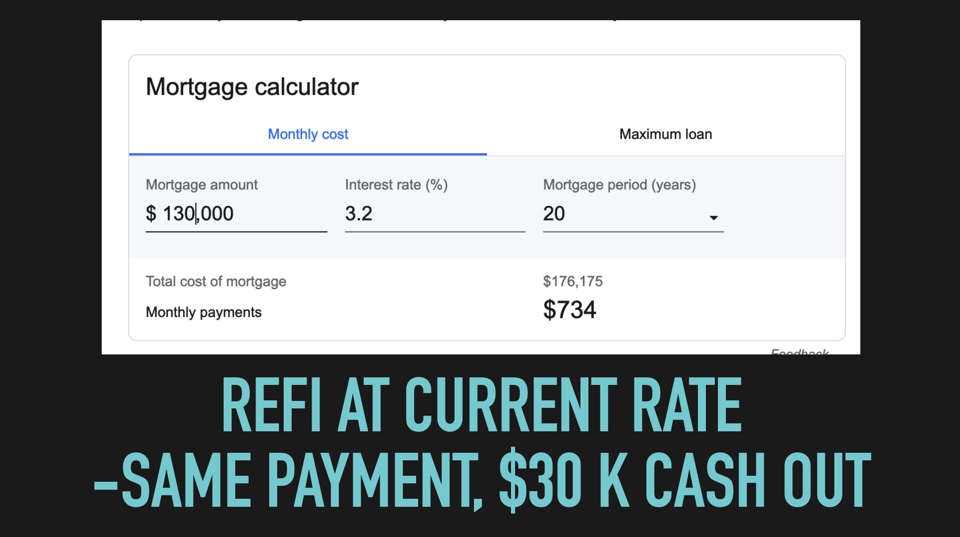

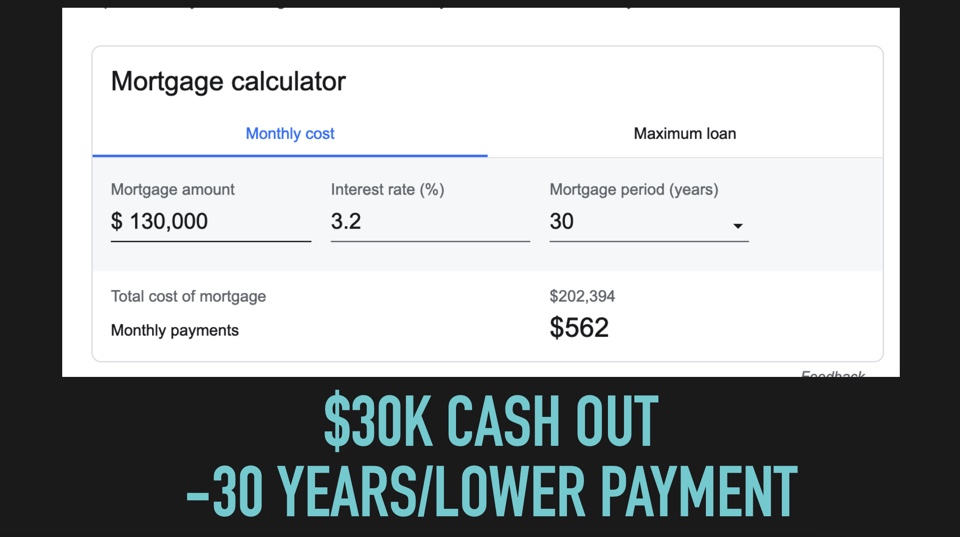

A “cash out” refinance gives the homeowner(s) a chance to take out a new mortgage for a larger amount than the original one, and then have that money available for other needs, such as a home improvement project or paying off high-interest debt. (Update: the Wall Street Journal has a recent article explaining the trend of cash-out refinance.)

For instance, if the current mortgage value is $100,000, and the home is worth $200,000, a mortgage of $150,000 is doable, and around $50,000 (minus fees and expenses of refinancing) would go to the homeowner.

A cash-out refinance is best under some or all of the following conditions:

- over 50% of the home’s value is paid off.

- specific goals and a detailed plan are in place for the “cash out” money.

Otherwise, the money might just be frittered away.

- if a new monthly mortgage payment would be about the same, or not much more than, the current payments.

*Option: refinance for lower monthly costs

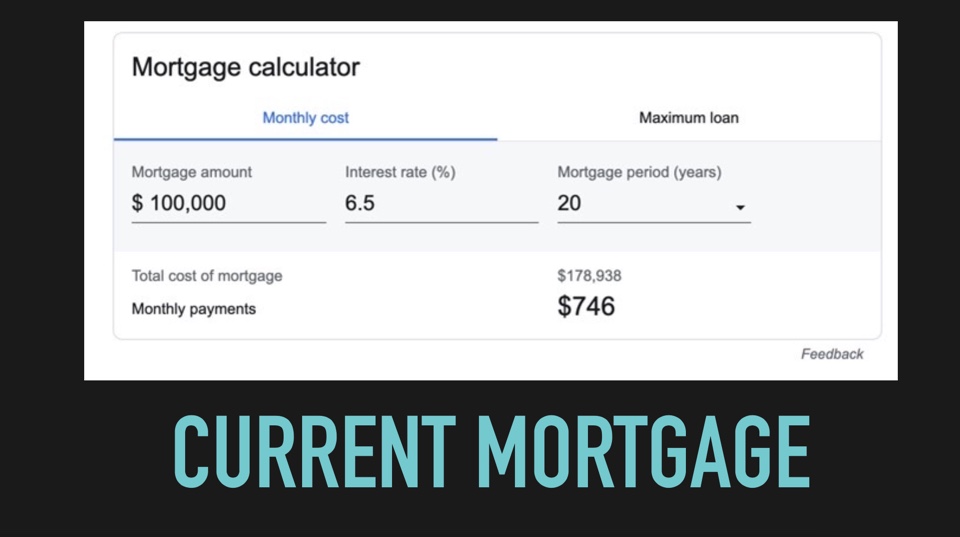

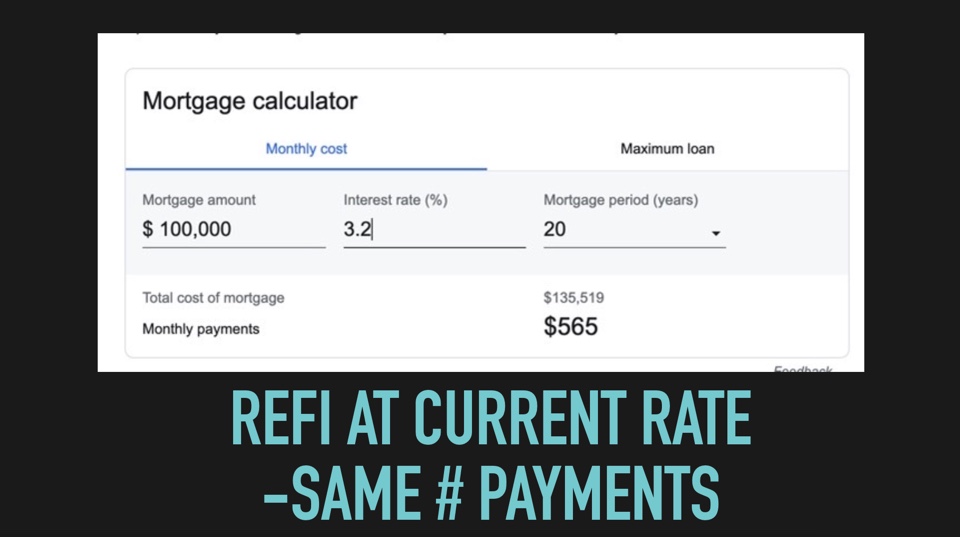

Typically, refinancing for a lower interest rate, but the same term left on the loan, will reduce the monthly payments.

For example: it might reduce a $650 monthly payment with 20 years left in its term to $400 with a 20-year, lower interest rate mortgage. But a 15-year mortgage might still only be $450; saving the homeowner $200.

*Option: refinance into a shorter loan period

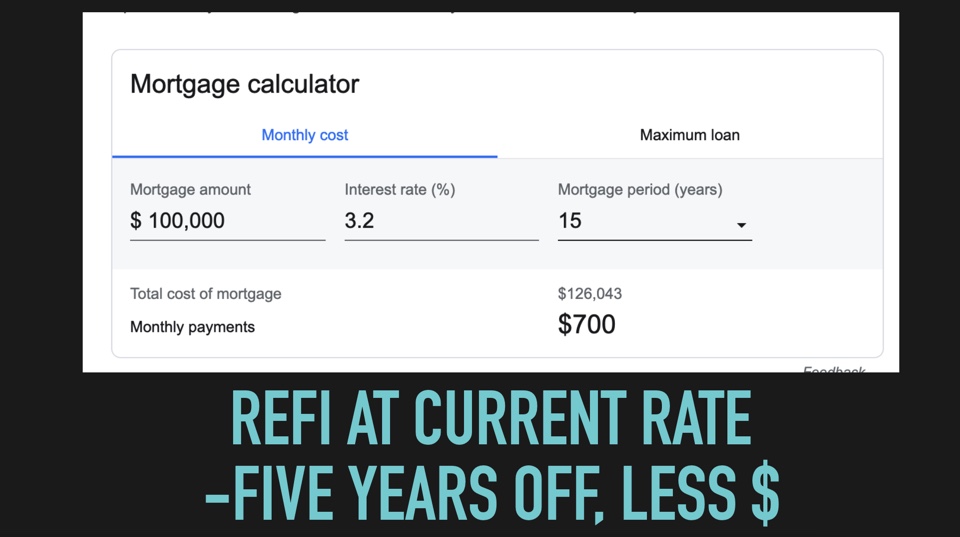

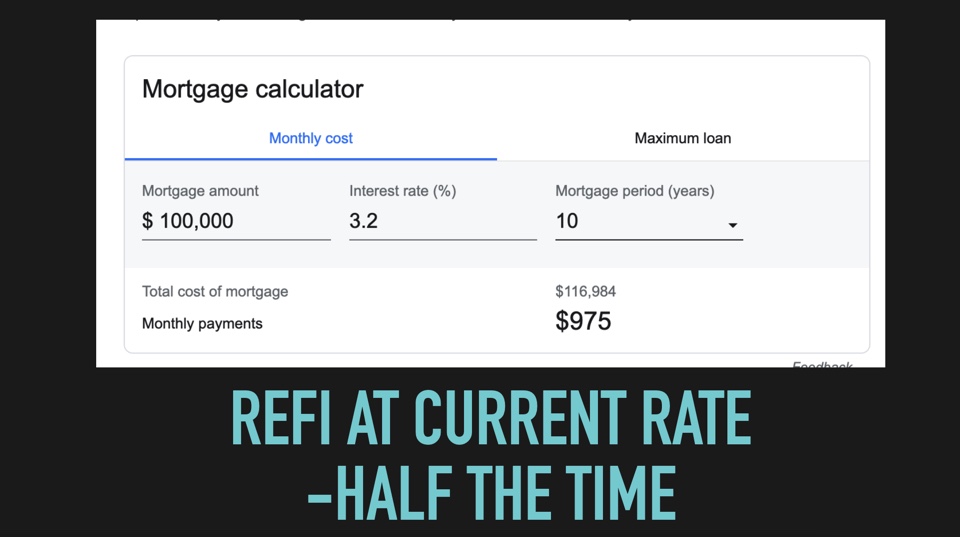

Depending on the difference in interest rates between the old and new mortgage, the monthly payments could stay the same, but have a much shorter term.

Google has a very simple tool you can use to run some numbers. Here are screenshots of the different options:

Run the numbers—your numbers

Now it’s time to run the numbers–your numbers.

Here is what you need:

- current mortgage payment (minus escrow)

- current interest rate

- your current loan balance & remaining # payments

- value of house (Zillow is fine)

- *your credit score

As demonstrated above, run some scenarios through the helpful, very simple calculator on the Google results for mortgage calculator,

What about break-even point? This is the time it takes to recoup the costs of refinancing. Costs can vary widely, but can run from $1,000 to $4000 and more.

However, the break-even point may not matter as much for those using a refinance to pay off high-interest debt such as credit card debt. The value of having that debt paid off will easily pay off quickly, assuming the homeowner determines to pay off credit cards each month from now on.

This helpful calculator from Zillow shows you the “break-even” point of a mortgage refinance. Playing around with the numbers here will help you get a sense of how long it would take for refinancing to “pay off” for you.

Have a plan for leftover $

If you do plan to refinance and lower your payment or take cash out of the house, having a plan for that money is critical.

For instance, let’s say you’re going to save $300/month on your mortgage. What are your plans for it?

Consider some specific goals:

- pay off credit card debt

- put more money towards student loan debt

- increase your emergency fund

- save money in accounts for specific goals

Consider doing a combination of the above so that you can continue to do good with the extra money. If you don’t “give it a job,” you may find it slip away to random expenses.

Prepare for a lot of work—it can be worth it

If you decide to refinance, here are some basic tips:

- do not open any new credit cards. Do not close any new credit cards. Both can negatively affect your credit score.

- get multiple quotes for rates. It’s easier than ever, with online sources like Rocket Mortgage, Lending Tree, and others.

- consider local banks.

Your local bank may have a better rate than the national or online companies, especially in closing costs and fees. Be sure to comparison shop!

- prepare for a lot of work. It can be a tiring process, with so much information needed and forms to fill out, but if refinancing is right for you, it can be worthwhile.

Have you refinanced your mortgage in recent months? How was your experience?