Your challenge: Open up at least one “money fund” and automate savings to the account(s) weekly or monthly.

Time commitment: one half hour to one hour.

I wish I had a better name for “money funds.” Many personal finance websites call these “sinking funds,” but that name just annoys me. If you have a good catchy alternative, let me know.

What are “money funds” and what kind should you have?

A “money fund” is simply a dedicated account to save for a specific planned expense or goal in the near or far future. So, for instance, you could have a “travel fund” to pay for your $2,000 summer vacation. If you put $200 in each month, you will have enough for that vacation in 10 months.

I recommend having multiple money funds for different goals and expenses. Here are seven categories you might consider:

Emergency Fund:

This is the first, and most important, money account to fund. As covered before, you should start with a bare minimum of $1,000 (and eventually more). Having that separate from your other money funds is a great way to keep the emergency fund “safe” and allow you to spend the money in other accounts guilt free on those goals.

Charity:

A dedicated money fund for giving to charity is a great way to build up the amount of money you have to give away. This can also be helpful if you try to give larger amounts at certain times of the year, such as during Lent or before Christmas. You can use this fund to give to your church or other charity regularly and also give to specific causes.

You can even use this charity account to fund a donor-advised fund, allowing you even more freedom in when you give; tax benefits, and more.. Here is more about donor-advised funds.

Travel:

If you know that you often spending a certain amount of money each year on travel spending—such as visiting in-laws or other families for Christmas, and other vacation plans— have a travel money fund.

For example, if you spend about $3,000 a year on travel, putting aside $250 each month will easily help you cover those costs without being “stretched” when the actual travel is occurring.

Education:

Let me just say that I feel you on this one, since my husband & I have two children in college and one in Catholic high school. It’s so difficult to make a big dent in their college costs (that’s why this Onion article-satire/kinda-is an evergreen favorite), but every bit helps.

A 529 plan for most families is the best way to have this education savings account—but most times, only for college. Some states, but not all, allow parents to use 529 plans for private elementary and high school costs. Illinois is one of those states that do not allow 529 spending for school before college, so we have a separate money fund for high school tuition.

It is hard to give an example in college savings because it’s so variable. Just opening a 529 or other money fund and putting something in there regularly is a good idea.

House:

This money fund is key for both renters and homeowners. If you are a renter, this account can be earmarked for a downpayment for a house. Even if you’re not sure when this might happen, it’s not a bad idea to have a specific account for this. The money could always be used for home purchases such as furniture or other improvements.

If you are a homeowner, the rule of thumb is to save between 1 to 3 percent of your home’s value each year for repairs. So work to get your savings rate in this fund to this level ASAP.

So, for example, if your home is worth $100,000, plan to save about $1,000 to $3,000 per year. Some years you will spend way less, and some you will spend way more (new roof or furnace).

By the way, the 1 to 3 percent savings guideline is separate from a home renovation project, such as redoing a bathroom or adding a deck.

Auto:

The more you can save here, the better, since car loans are not generally a good idea, or at least keeping that number down as much as possible is ideal.

This fund would be for both the cost of repairs to a current vehicle or vehicles, but you can also figure out your annual costs for registration & insurance here, gas, and any repairs and divide that by 12 months, and save at least that much, if possible.

It’s also a good idea to save for your next vehicle. A good way to do this easily: once you have paid off a car loan, divert that amount of money (and more if possible!) into the auto money fund.

Christmas & Birthdays:

Have you heard of a “Christmas Club”? (and not the Hallmark movie, which is very loosely based on the original concept).

For all you younger readers, banks would have accounts called “Christmas Club” accounts, dedicated to Christmas spending. Account owners would deposit small amounts–actually in person. If you made regular deposits, come Christmas, you would have a good chunk of guilt-free money.

[The origin of Christmas Clubs is semi-interesting, if you’re inclined to learn about it.]

Especially if you have a lot of family to buy gifts for (or gift-giving is one of your love languages), have this kind of money account.

There could be many other types of money funds, but you get the picture.

Why should you open multiple money funds?

You should open multiple money funds for many reasons, but this is mostly a “money mindset” tip.

Money mindset is much more important than we realize in achieving what we want related to money. This is a great post explaining how you can grow rich thinking about money—not in a “woo-woo” way—but in a way of paying attention and developing intention with your money will lead you to make smarter decisions in your financial life.

You don’t “have to” set up multiple money funds. In fact, we did not for many years—we just one account for everything—emergency fund, etc. You could just keep it all in one account and use as needed. That’s because all of your money is your money. It doesn’t matter whether you won it in the lottery or earned it from your job, or if it’s in an account called “Travel” or not.

But the mere process of “dividing up” between different funds is helpful in seeing your money. If you have $12,000 in a house fund, you are better able to fund a bathroom remodel, or think about a down payment on a house, or buy your next car. For our family, it’s been a truly helpful process to see what we have in different funds, and if we are spending and saving our money based on our highest values.

Having multiple money funds helps you have clarity about your money and then spend with intention.

Now we have accounts in multiple locations, all earning more interest than the typical savings or checking account that earns tiny amounts of interest.

Who should open multiple money funds?

Everyone. For instance, even a teen can set aside $1,000 for an emergency fund, even if they still live and home and parents take care of their housing, etc. And then open several other savings accounts for near-term and far-term goals.

Ramit Sehti writes about how saving for something you know will probably happen in the future—a wedding, a house purchase—you can easily save up large amounts by small contributions each month from a young age.

For example: If you are 25, and think you’d like to buy a house when you’re 30, you would have $12,000 (more with interest) if you put away just $200 a month towards this goal. Automating it is the way to do this most successfully.

Where should you have your money funds?

Money funds should be in something easy to access—but maybe not too easy, so you’re not tempted to take it out. You should also try to get as much interest as you can. Online banks usually have the best rates.

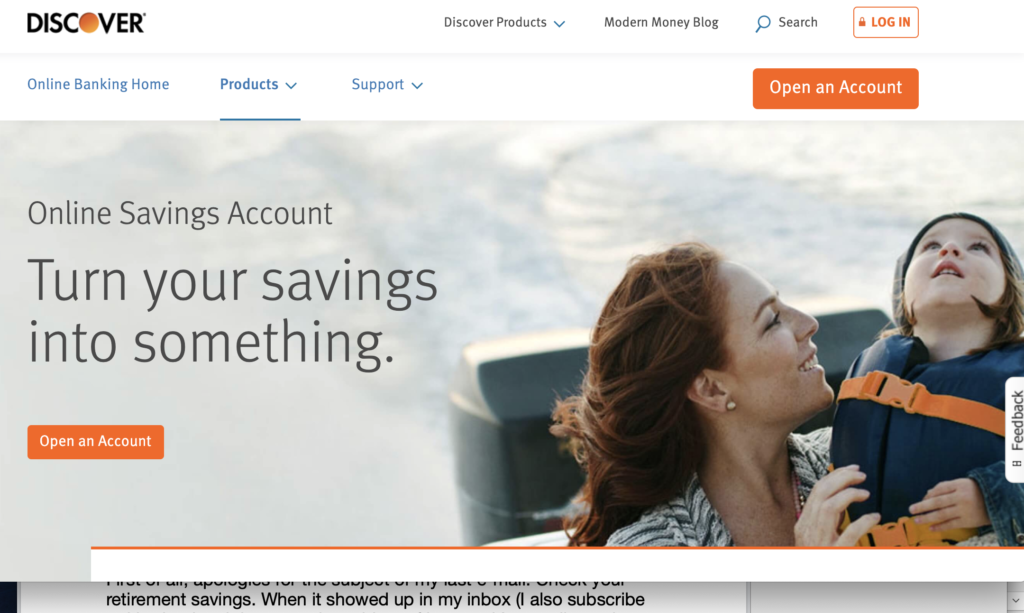

I am familiar with Discover Savings Accounts and Ally Bank. I also have clients who use Capital One Savings Accounts for their money funds.

Most online banks allow you to set up easily multiple accounts each with different names. And the interest rate is usually pretty high, comparatively and at much higher rates than at your local or national bank.

How to open multiple money funds

My advice? Make it as easy as possible. Open savings accounts at an online bank or credit card company if you already have a relationship with them.

It is very easy to open a savings account at any of these online banks—here are a few screenshots. If you already have an account (for instance, if you have a Discover credit card), it is even easier. Repeat the process for as many accounts as you want.

Discover

Capital One

Ally

There are many other online banks and services to choose from, so if none of these is a good fit for you, do some research and choose another. But getting started, and automating your deposits into those accounts (however small), is the most important thing,

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURE FOR MORE INFO.