(updated 2023)

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURE FOR MORE INFO.

Update, January 2020: After many months and a lot of work, my credit report no longer includes the fraudulent bills, and my credit score is back at its prior level.

Looking on the bright side of identity theft …

If you follow me on Instagram (I’m @yourmoneymom there), you already know that I discovered late last week that my identity was stolen.

Is it odd that one of my first thoughts when I discovered this is “This is going to be great for working with clients”?

I will write/talk/teach a lot more about this, but I wanted to put up this quick post for some to-dos for any of you who wonder what you can do today to do something about

1. checking into this yourself and

2. preventing identity theft as much as you are able.

How did this happen and how did I discover this?

I am not sure exactly how it happened. But after some research I think it is likely because I (and millions of others) were affected in the Equifax breach.

How did I discover it? When I paid a credit card last week, I checked my credit score. (Many credit cards offer this as a free service.)

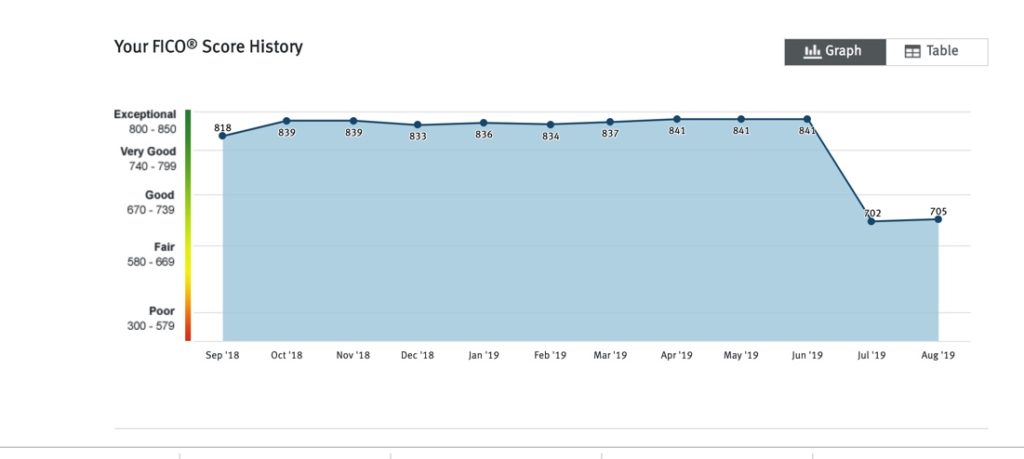

Normally, I actually enjoy getting to see mine and check it often. This is because, secretly, I have had this fond hope that one day I might be like Michelle Singletary and find out I had the rare “perfect” credit score of 850). (Update: I have seen a perfect score on my FICO Scorecard at least three times. It’s wonderful!)

I was horrified to see that my credit score was 702. 702!

Immediately, I went to annualcredtireport.com to request a free credit report.

At the time I wrote the original post, federal law mandated that you can get three free ones each 12 month period–once for each of the credit bureaus. But currently, anyone can now receive weekly credit reports from all three credit bureaus.

My credit report showed that in May, someone in Florida had opened credit –in my name–with Verizon and charged $1,800 plus. Does an iPhone even cost that much?

The account was sent to collections on July 31, so that is when my credit score took the hit.

I’ve been taking a lot of steps to “lock down” my credit and identity. I promise to write much more about it in future, but this is still underway. A police report is next on my list …

Let’s just cover quickly what you can do to see if your financial information is compromised, and what to do to prevent it.

What can you do today?

1. Check your credit score

This is easiest to do if you have a credit card that offers it. I have a Discover card and a Chase card that offer free weekly updates in my credit score. Most people do, so that’s your easiest start. The credit score will reflect any changes. For example, here is a screenshot of my FICO snapshot:

If there has been any big change in yours, it’s time to join the IdentityTheft.gov friend group. Most of you won’t be in this category, thankfully!

2. Check your credit report.

If you haven’t done so recently, obtain a free credit report from annualcreditreport.com. This is a site mandated by Federal law, but operated by the three major credit bureaus.

By law, you are entitled to receive one free credit report each 12 months from each of the bureaus. As I mentioned above, you should space them out over the year so that you can check in every four months on any changes.

Note: there are plenty of other places to see your credit or get your credit report. I can review different services in future, but for now just do the free, federally mandated website.

3. Consider freezing your credit.

Because my identity was stolen, I have access to the cool “credit fraud alert” for (likely) seven years. If you’re just a normal mortal, a credit freeze is available to you.

What is a credit freeze?

A credit freeze, also known as a security freeze, does not allow anyone—including you—apply for credit, whether a mortgage, a credit card, or other debt. It is the best way to help prevent new accounts from being opened in your name. Because of data breaches in recent years, credit freezes are now free (they used to cost $10 or more). A credit freeze doesn’t affect your credit score. You “unfreeze” your credit when you want to apply for a loan or credit card.

Should you do this? Yes, you should.

I had not done this previously, because I am actively accumulating credit card rewards. I did this mostly for convenience so that I did not have to unfreeze it whenever I was applying for a credit card.

Clearly, this was not my finest money move.

In fact, I was “just” thinking about having a feature called My Money Mistakes Monday” on my podcast on the theory that we can all learn from each other’s mistakes so we don’t have to make all of them on our own. Famous last thoughts…

How to freeze your credit:

Note: I recommend that you request at least one credit report (see above) before you freeze your credit, because I’m not sure if it would make it more difficult to get the credit report.

You have to freeze your credit report at all three bureaus.

Here is a link to each:

Equifax.

Go here to start the process of freezing your credit at Equifax. Note: Equifax has a product called “Lock & Alert” that is not necessarily a bad thing (it’s free), but it is NOT a credit freeze. If you want a security freeze (and I recommend you do), be sure you are filling out the right information.

Experian.

This helpful article has the links and shows you what to do to freeze your credit at Experian.

Transunion.

Transunion also has a helpful and easy-to-use web page about freezing and unfreezing credit.

Some final thoughts:

*It is NOT a super quick process to freeze your credit. Get a cold or hot beverage and/or some chocolate and a notebook out. You’ll need to answer a number of questions to verify your financial identity.

These questions include things like “At which bank do you have a mortgage?” or “How much is this car payment per month?” And it is multiple choice so it’s pretty easy to complete. But all of this takes time!

*You will have to create a strong password and often a PIN to freeze/unfreeze your credit. Be ready, and get through it.

*You should do this for each member of your family who is over 18.

In the coming months (yes, this will be a long process) I will share all about the process of recovering from identity theft.

What other questions do you have about identity theft or your credit score or credit report?